From the Desk

Our From the Desk publications serve as an avenue for us to discuss in-depth education policy issues that we support.

From the Desk—What the Reconciliation Bill Means for Illinois Children, Families, Schools and Communities

On July 4, President Trump signed the One Big Beautiful Bill Act (OBBB), a piece of federal spending legislation that makes significant changes to Medicaid, SNAP, and federal college loan and scholarship programs, the impact of which will be felt in the short term—as is the case with student loan disbursement and repayment conditions—as well as in the long term — like with Medicaid cutbacks, whose impact will unfold over time.

Below, we offer some explanations of the changes and their implications for schools and the students, families, and communities they serve, along with links to additional materials and in-depth coverage.

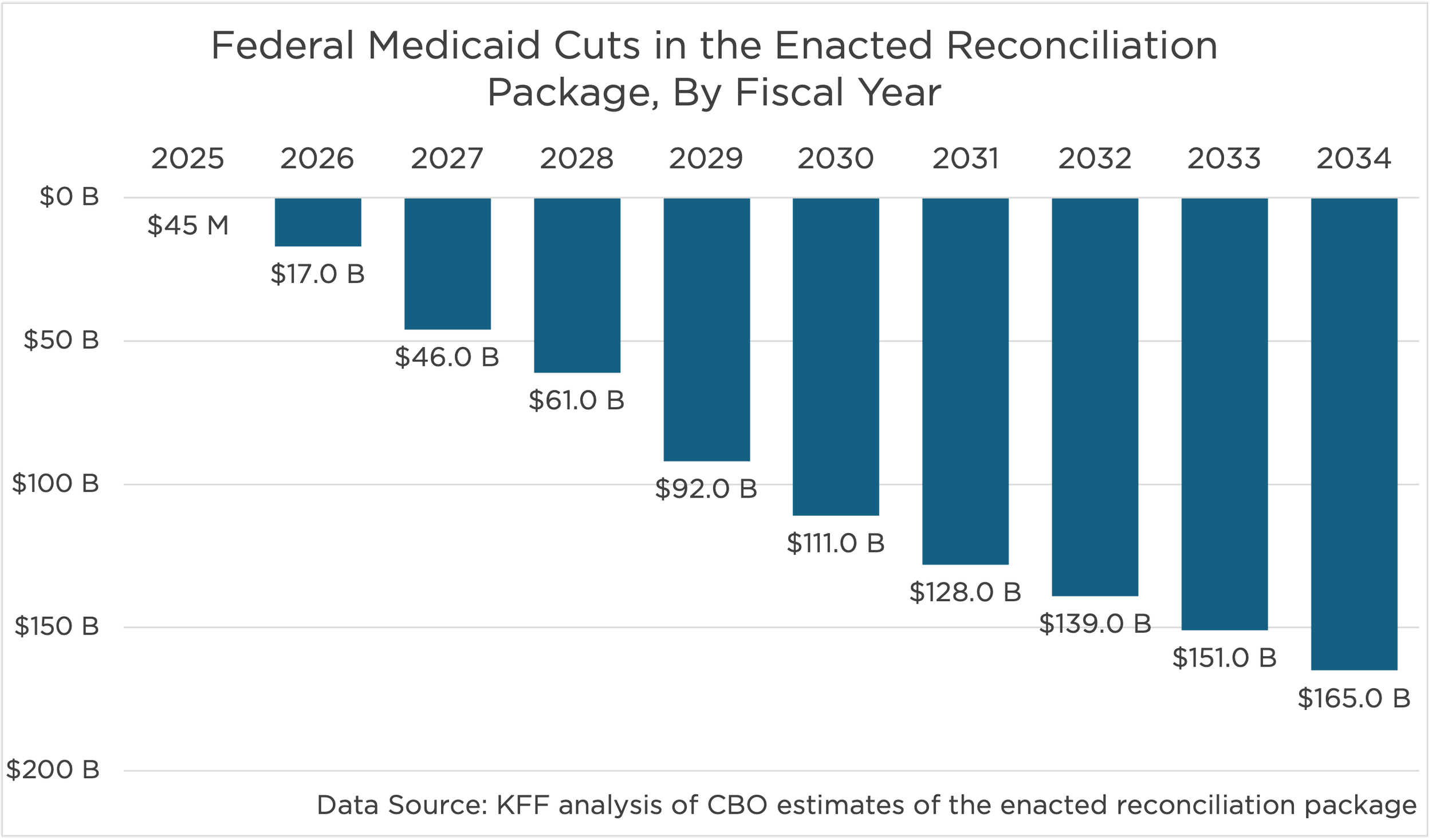

First, let’s take a look at how OBBB will impact Medicaid access. Over the past 10-15 years, the federal government has worked, largely consistently, to expand access to Medicaid, to make it easier for families to apply, and to simplify schools’ ability to seek reimbursement for medical care provided at or through schools. In an effort to cut costs, the current administration proposed, and OBBB codified, a series of changes to Medicaid they claim will save $911 billion over the next 10 years.

I imagine it’s obvious to even a casual observer and average math student, that the only way to save $911 billion is to reduce the number of people being served by Medicaid. In fact, experts from the nonpartisan Congressional Budget Office estimate that the changes now underway could result in more than 10 million Americans losing coverage over the next 10 years; including anywhere from 270,000 to 500,000 in Illinois alone. Here are some of the key changes:

OBBB imposes significant new work requirements — something that previous administrations had deliberately avoided — in an effort to expand medical coverage. Data suggests that work requirements can in fact save federal dollars, but a pilot program in Georgia revealed that savings derive largely from under-enrollment. That is, the additional complexity created by understanding, complying, and verifying eligibility resulted in just 7,500 of roughly 240,000 eligible Georgia citizens receiving coverage. Worse, the increased paperwork requirements drove costs of enrollment up from an expected $2,490/participant to over $13,000/participant. Notably, a similar work requirement program in Arkansas did not meaningfully increase employment.

OBBB adds significant new reporting and verification steps, including requiring participants to verify eligibility every 6 months instead of annually, a change that both depletes time parents can spend with their children and likely will result in people losing coverage for reasons having nothing to do with need.

OBBB rescinds eligibility for a significant number of lawful immigrants. Specifically, the bill revokes access for refugees, individuals granted parole for at least one year, individuals granted asylum or related relief, certain abused spouses and children, and certain victims of trafficking. This is a devastating blow to vulnerable populations. Only some lawful immigrants maintain access to Medicaid and the Children’s Health Insurance Program (CHIP) under the new law: lawful permanent residents, certain Cuban and Haitian immigrants, and COFA migrants. Children and pregnant adults may still qualify through the Immigrant Children’s Health Improvement Act (ICHIA) only if the state they reside in opts into ICHIA. This provision goes into effect October 1st, 2026.

You may be wondering what this means for schools and their communities across Illinois. Here are some things to keep in mind:

Schools can get reimbursed for various health services provided to students who are enrolled in Medicaid or CHIP programs, and limits on eligibility will impact schools’ abilities to provide these services. Medicaid reimbursements are often used on telehealth, contracted services for mental and/or behavioral health, technology, care coordination and referral services, and Medicaid outreach and enrollment services. These reimbursements allow schools to provide crucial services to children where they spend most of their time—schools. As students lose access to Medicaid and CHIP, schools’ ability to fund important services will be impacted, leaving many students vulnerable.

Multiple analyses suggest that rural hospitals will be at greater risk of closing. Why? Rural hospitals serve a large number of Medicaid patients. As those patients lose coverage, the hospitals that serve them will lose reimbursements and/or patient load. Analysts looked at caseloads and prior financial margins to determine which rural hospitals, nationally, will be at risk for closure due to provisions in OBBB. The results identified over 300 rural hospitals across the nation at risk of closure, conversion, or service reductions — severely impacting the communities that rely on them. 9 of these rural hospitals are in Illinois; 5 of the 9 hospitals at risk are top Medicaid providers, and the other 4 have struggled financially.

Additional Ripple Effect: Should these hospitals close, clinics and primary care providers who depend on them will also be impacted and/or close. Taken together, the likely impact of Medicaid changes in OBBB will be to limit the services accessible to rural communities, pushing families to travel greater distances for healthcare, or lose out entirely.

Special Note: In response to concerns about rural hospitals potentially being forced to close, the final version of the bill creates a special grant program designed to shore up rural hospitals. This will hopefully help institutions withstand additional financial pressure, though it seems worth pointing out that the money set aside for this pot — $50 billion — will no longer get to hospitals by way of providing care for ailing rural residents.

Next, let’s take a look at how OBBB will affect SNAP. SNAP, or the Supplemental Nutrition Assistance Program, is a federal program that helps low- and no-income people purchase food. Here, too, OBBB seeks to save money by cutting access to this 86-year-old program.

OBBB rescinds eligibility for a range of legal immigrants. The same groups of legal immigrants who are losing qualified status for Medicaid will also lose qualified status for SNAP. Refugees, asylum seekers, certain abused spouses and children, and certain victims of trafficking who rely upon the program for food security will be left without aid.

Governor Pritzker’s office projects that as many as 360,000 individuals will lose access to some or all SNAP benefits in Illinois. This population includes children and families that need this assistance to survive, and to be healthy and prepared to learn.

The bill also expands work requirements for SNAP recipients. The population of individuals subject to the work requirements increases from 190,000 to 450,000. This population includes former foster college students, young adults experiencing homelessness, and families with children ages 14-18.

Additional Ripple Effect: Because enrollment in SNAP qualifies families and individuals for auto-enrollment in free and reduced-price lunch programs, loss of SNAP will also complicate the ability of vulnerable families and young people to access other benefits.

Finally, let’s take a look at how the reconciliation bill will impact student loans for college and postsecondary education. The United States has a history of investing in education. We were one of the first countries to ensure public education for all students through high school, and the U.S. has worked assiduously to provide an array of loan programs designed to remove financial barriers for as many students as possible. As a result, the United States has boasted one of the most educated populations in the world — a factor unquestionably tied to the country’s strong economic presence on the world stage. OBBB represents a stark departure from this tradition. It dismantles key elements of the federal student loan system, increasing financial barriers by eliminating the Grad PLUS loan program and imposing strict annual and lifetime caps on Parent PLUS loans:

While Stafford Loans remain, their limits — $20,500 annually and $100,000 lifetime for graduate students — are insufficient to meet the full cost of education. Nearly 45,000 Illinois students benefitted from either a Parent or Grad PLUS loan during the 2023–24 fiscal year, with a total value of $1.16 billion. Parent PLUS loans, now capped at $20,000 annually and $65,000 over a student’s lifetime, will no longer fill gaps for many dependent undergraduates.

These shifts will disproportionately impact first-generation students and students of color, along with the institutions that serve them — particularly underfunded public universities like Chicago State University and Northeastern Illinois University, where Parent PLUS usage is highest. While the bill limits some forms of debt, it does so by limiting access without meaningfully improving affordability.

According to the most recent Department of Education statistics, 25.9 percent of Black students took out a Parent PLUS while pursuing a bachelor's degree, compared to 12.6 percent of White and 6.9 percent of Asian students. However, the size of the loan was smaller on average.

According to the Education Data Initiative, 40 percent of Black students take out loans for graduate school, compared to 22 percent of white students.

OBBB also eliminates all existing income-driven repayment (IDR) plans — including ICR, PAYE, REPAYE, and SAVE — and replaces them with a single, inflexible Repayment Assistance Plan (RAP). IDR plans were designed to align monthly payments with income and provide eventual forgiveness, particularly for those in public service and lower-wage sectors.

*RAP sets a $10 base monthly payment for all borrowers regardless of income, whereas previous plans did not have monthly requirements for individuals in the lowest income brackets.

*However, for those same low-income individuals, the government will ensure that the principal balance decreases by at least $50 each month. That means for borrowers making a $20 monthly payment, the government will remove an additional $30 from the principal.

*Forgiveness now takes place after 30 years of payment rather than the 20-25 years under previous plans.

Ripple Effect: Removing the previously existing protections transforms student debt into a long-term financial burden, with fewer offramps for those struggling to repay. Rather than reducing the cost of college, the bill codifies its risks—turning student loans into a tool of exclusion rather than advancement.

In Conclusion….

It is clear the changes are significant and so too will be the impact. All will affect student wellness and well-being and, in turn, academic opportunities and outcomes. As such, it is our responsibility to understand these changes and do all we can to ensure students, particularly those most reliant on public support, have what they need to learn and grow.

NEXT STEPS

Are you interested in keeping up-to-speed on federal changes in education and early care and their impact on Illinois children, students, and families? Email Jim O’Connor, Project Director, at joconnor [at] advanceillinois [dot] org for more information.

Would you be willing to share how federal changes - including cuts, rescissions, and freezes - have impacted your work or experiences in education? Complete this survey to share your story.